How Bond Funds Work

- Jun 17, 2025

- 2 min read

Bond funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of bonds, managed by professional fund managers. These funds invest in various types of bonds, such as government, corporate, municipal, or international bonds, depending on the fund’s objective.

Unlike individual bonds, which have a fixed maturity date, bond funds do not mature, allowing investors to buy or sell shares at any time. The fund generates income primarily through interest payments from the bonds it holds, and its value is reflected in the net asset value (NAV) per share, calculated daily based on the market value of the underlying bonds.

Payout Structures

Bond funds typically distribute income to investors in the form of dividends, which are derived from the interest earned on the bonds in the portfolio. These dividends are usually paid monthly, quarterly, or annually, depending on the fund’s structure. Investors may choose to receive these payouts as cash or reinvest them to purchase additional shares, compounding their returns over time. Some funds also distribute capital gains if bonds are sold at a profit, though this is less common. The yield, or effective return, depends on the fund’s bond holdings, expenses (e.g., management fees), and market conditions. For example, a fund with higher-yield, riskier bonds may offer higher payouts but with increased volatility.

Fluctuations

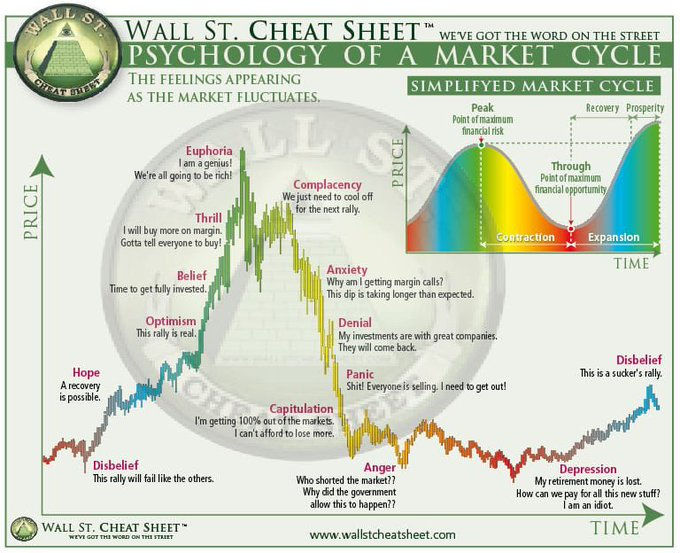

The value of a bond fund’s shares fluctuates based on changes in the market value of the underlying bonds, which are influenced by interest rates, credit quality, and economic conditions. When interest rates rise, bond prices typically fall, reducing the fund’s NAV and share price. Conversely, falling interest rates increase bond prices, boosting the NAV. Other factors, such as changes in the creditworthiness of bond issuers or shifts in market demand, can also cause fluctuations. Unlike individual bonds, bond funds do not guarantee the return of principal, as their value continuously adjusts to market conditions. Short-term fluctuations may be more pronounced in funds holding longer-duration or lower-quality bonds.

Risk Profile

Bond funds carry several risks, varying by the type of bonds in the portfolio:

Interest Rate Risk: Rising interest rates can decrease bond prices, lowering the fund’s NAV.

Credit Risk: Bonds issued by corporations or lower-rated entities may default, impacting fund returns, especially in high-yield (junk) bond funds.

Liquidity Risk: Some bonds, particularly in niche markets, may be hard to sell quickly without affecting prices, impacting the fund’s ability to meet redemption demands.

Inflation Risk: Inflation can erode the purchasing power of fixed-income payments, particularly for funds with long-term bonds.

Manager Risk: Poor investment decisions by the fund manager can lead to underperformance.

Government bond funds (e.g., Treasury funds) are generally lower risk, offering more stability but lower yields. Corporate or high-yield bond funds offer higher potential returns but carry greater credit and default risks. International bond funds add currency risk due to exchange rate fluctuations. Investors should assess a fund’s duration (sensitivity to interest rate changes), credit quality, and expense ratio to understand its risk profile.

Bond funds are suitable for investors seeking income and diversification but require careful consideration of risk tolerance and market conditions.