The top macro trends for the next 10 years

- May 20, 2025

- 5 min read

In a world growing more challenging and competitive, financial literacy is essential for capitalizing on the macro trends shaping investments over the next decade. These trends, driven by technological, demographic, economic, and environmental shifts, present both opportunities and risks. Below, I outline the key macro trends influencing investing for the next decade, emphasizing how financial literacy empowers individuals to navigate them effectively. The trends are informed by current analyses and projections from various sources, including web insights and discussions.

Key Macro Trends for Investing (2025–2035)

Artificial Intelligence (AI) and Technological Disruption

Trend: AI, machine learning, and automation will revolutionize industries, from finance to healthcare. AI-powered tools like next-gen robo-advisors are transforming investment strategies, enabling rapid portfolio optimization and predictive modeling. By 2030, AI’s impact could add $15.7 trillion to the global economy, with significant growth in AI-driven companies. However, early-stage bubbles in AI stocks, as seen with past tech trends, are a risk.

Investment Opportunities: Companies developing AI infrastructure (e.g., semiconductors, cloud computing) and applications (e.g., cybersecurity, quantum computing) are poised for growth. Examples include Nvidia (despite recent volatility) and mid-sized players like Rigetti Computing, which focuses on quantum technology with 140% projected revenue growth.

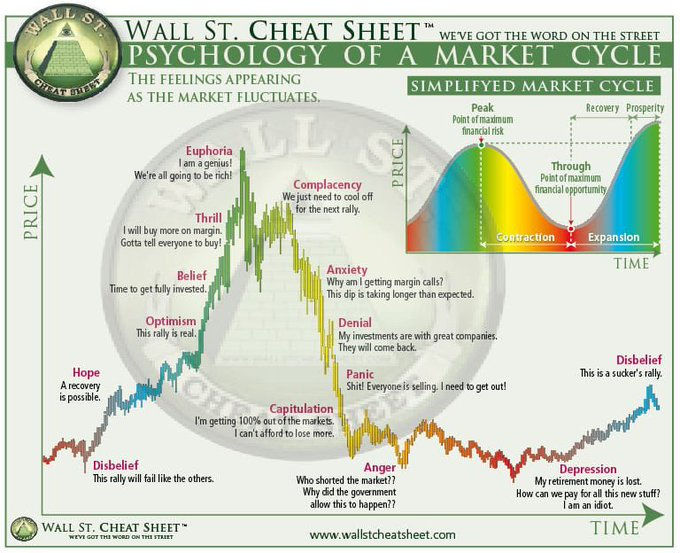

Financial Literacy Role: Understanding AI’s risks (e.g., overhyped valuations) and opportunities requires knowledge of market cycles and due diligence. Financially literate investors can assess fundamentals, avoiding speculative traps while targeting innovative firms.

Sustainable Investing and ESG (Environmental, Social, Governance)

Trend: Sustainability is a priority, with ESG funds projected to grow from $4.5 trillion in 2021 to $10.5 trillion by 2026, driven by consumer demand (66% of consumers prioritize sustainability) and regulatory shifts. Renewable energy, particularly solar, is a key focus, with states like Texas and Florida leading adoption due to cost declines.

Investment Opportunities: Green energy stocks, sustainable agriculture, and carbon capture technologies (e.g., backed by companies like BP or Chevron) offer long-term potential. However, challenges like solar panel efficiency and disposal costs require scrutiny.

Financial Literacy Role: Evaluating ESG investments demands understanding metrics like carbon footprints and governance risks. Financial literacy helps investors avoid “greenwashing” and assess true sustainability impacts, balancing returns with values.

Demographic Shifts and Aging Populations

Trend: Aging populations in developed nations (e.g., 19% of the population over 65 in 2021) and a growing middle class in emerging markets (e.g., India, China) will drive demand for healthcare, senior care, and consumer goods. By 2035, discretionary spending in developing economies could rise 6.9% annually.

Investment Opportunities: Healthcare stocks (undervalued with a forward P/E of 16.9 vs. S&P 500’s 22.3) and companies targeting emerging market consumers (e.g., Alibaba) are attractive. Real estate firms like LTC Properties, catering to millennials and seniors, also stand out.

Financial Literacy Role: Budgeting for long-term goals like retirement and understanding demographic-driven demand (e.g., healthcare costs) enables informed stock picks. Literacy helps investors diversify across regions and sectors to capture growth.

Digitization and Web3 Technologies

Trend: Digitization, including blockchain, 5G, and Web3 (decentralized internet with NFTs, cryptocurrencies), is reshaping economies. The Web3 market could grow at a 43.7% CAGR through 2030, with venture capital funding surging. Cryptocurrencies like Bitcoin may hit $100,000 by 2025, driven by events like the 2024 Bitcoin halving.

Investment Opportunities: Blockchain firms, crypto ETFs (e.g., Europe’s spot Bitcoin ETF), and companies in digital payments or cybersecurity are promising. However, volatility and regulatory uncertainty (e.g., SEC delays on U.S. crypto ETFs) pose risks.

Financial Literacy Role: Understanding complex assets like cryptocurrencies requires knowledge of risk management and regulatory landscapes. Financial literacy helps investors avoid scams and time entries during volatile cycles.

Geopolitical Fragmentation and Reglobalization

Trend: Geopolitical tensions (e.g., U.S.-China trade wars) and “slowbalization” are reshaping supply chains and investment flows. U.S. tariffs could reach their highest since the 1930s, impacting global trade. Meanwhile, reglobalization may favor dominant markets over emerging ones, with structural reforms in Europe and rising taxes influencing capital flows.

Investment Opportunities: Companies resilient to supply chain disruptions (e.g., diversified manufacturers) and those in stable markets (e.g., U.S. corporates) are safer bets. Private equity and credit in lower middle markets also offer growth.

Financial Literacy Role: Navigating trade policies and currency fluctuations requires understanding macroeconomic indicators. Financially literate investors can hedge risks and capitalize on policy-driven opportunities.

Renewable Energy and Resource Scarcity

Trend: Demand for renewable energy (e.g., copper for wind/solar) and sustainable food systems is rising due to climate goals and resource scarcity. Agrifood systems, responsible for one-third of global emissions, are under pressure to innovate, costing $3 trillion annually in environmental damage.

Investment Opportunities: Base metal producers (e.g., copper miners) and agritech firms addressing food security are set to benefit. Oil companies investing in clean energy, like TotalEnergies, also offer dual exposure.

Financial Literacy Role: Assessing resource-driven investments requires understanding supply-demand dynamics and environmental costs. Literacy helps investors evaluate long-term viability and avoid overhyped sectors.

Hybrid Work and Urban Shifts

Trend: The hybrid work model (preferred by 85% of workers) and remote work trends are reshaping real estate and consumer behavior. Urban depopulation and skill obsolescence (skills now relevant for ~5 years) drive demand for flexible investments.

Investment Opportunities: Fractional real estate platforms like Fundrise ($7 billion portfolio) and companies supporting remote work (e.g., cloud computing, Zoom) are growing. Real estate catering to millennials, like Silver Bay, also aligns with demographic shifts.

Financial Literacy Role: Understanding real estate cycles and passive income strategies is key. Financial literacy enables investors to assess platforms like Fundrise for liquidity and returns, balancing risk in a shifting urban landscape.

Why Financial Literacy Matters

In a competitive world, financial literacy is the foundation for leveraging these trends:

Risk Management: Knowledge of diversification and hedging protects against volatility in AI, crypto, or geopolitical shifts.

Opportunity Identification: Understanding financial statements and market trends helps spot undervalued sectors like healthcare or emerging markets.

Avoiding Pitfalls: Literacy guards against scams (e.g., crypto fraud) and overhyped investments (e.g., AI bubble risks).

Long-Term Planning: Budgeting and compounding knowledge align investments with goals like retirement, especially for aging populations.

Adapting to Complexity: Navigating fintech, ESG metrics, and global trade policies requires understanding financial systems and regulations.

Practical Steps for Investors

Educate Yourself: Use resources like Khan Academy, Morningstar, or X posts from credible finance creators to learn about markets and trends.

Start Small: Practice budgeting and invest in low-cost ETFs or fractional real estate to gain experience with minimal risk.

Diversify: Spread investments across AI, ESG, healthcare, and emerging markets to mitigate risks from geopolitical or tech disruptions.

Stay Informed: Monitor macro trends via platforms like BlackRock or New York Life Investments for geopolitical and economic updates.

Consult Experts: Engage financial advisors to tailor strategies to your risk tolerance and goals, especially for complex assets like crypto or private equity.

Conclusion

The next decade’s investment landscape will be shaped by AI, sustainability, demographic shifts, digitization, geopolitics, resource scarcity, and hybrid work. Financial literacy is critical to navigate this complex, competitive environment, enabling investors to seize opportunities (e.g., AI, ESG, healthcare) while avoiding risks (e.g., bubbles, fraud). By understanding these trends and applying financial knowledge, individuals can build wealth and resilience in a rapidly evolving world.