Why do investors run when stocks go on sale?

- Apr 21, 2025

- 2 min read

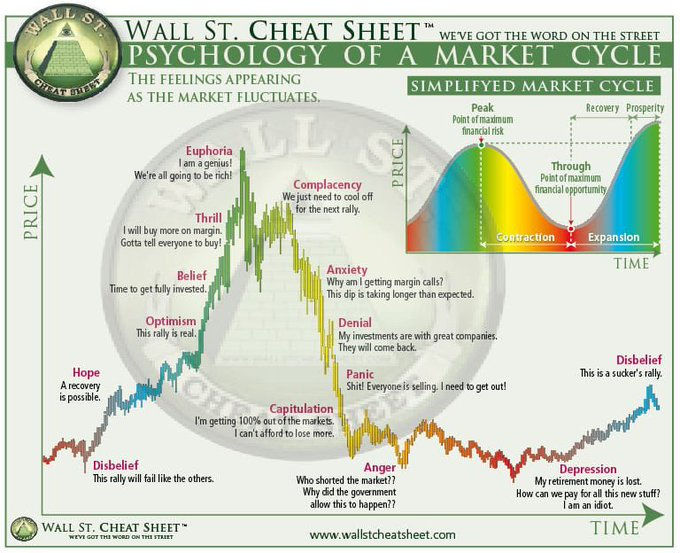

Its an interesting conversation isnt it? it highlights the psychology of investors.

Investing often feels counterintuitive. As Warren Buffett famously said, “The time to buy is when there’s blood in the streets.” Yet, fear often paralyzes us when stocks are “on sale,” preventing us from seizing opportunities.

Take the tariff war scare on April 2, 2025, as an example. Global markets plummeted amid uncertainty, with fears that Trump’s trade policies could trigger a recession. This sparked reduced spending, less money flowing into markets, and a broad sell-off. The prevailing mood was doom and gloom for the year. But within two weeks, a 90-day tariff pause was announced, negotiations began, and markets staged a V-shaped recovery over the next two weeks.

During this period, two types of investors emerged. One group, gripped by panic, sold their holdings after watching their portfolios shrink. The other group stayed calm, analyzed the situation, and looked for opportunities to buy at lower prices.

A month later, reflecting on the event, the investor who remained composed and applied logic came out ahead. Those who sold in fear likely regretted it.

In times of uncertainty, ask critical questions: What’s driving the fear? Is it temporary or long-term? Does this news alter the fundamental reasons for your investments? These questions help frame the situation logically, stripping away emotional bias—a key skill for building wealth.

I believe a vital question in both good and bad times is: What are institutions and hedge funds doing? Often, when retail investors are paralyzed by fear, smart money is accumulating. When you panic-sell, institutions may be buying your shares at a discount. When the market rebounds, they’re likely selling back to you as you FOMO in.

Understanding your own psychology is crucial in navigating markets. The urge to sell when your portfolio feels at risk or to buy when a stock seems unstoppable is natural. But markets are cyclical—parties end, and new cycles begin. Mastering your emotions to align with these cycles is essential for accumulating and preserving wealth.